Results 731 to 740 of 975

Thread: Occupy Wall Street protest

-

10-30-2011 #731Senior Member Platinum Poster

- Join Date

- Jul 2008

- Posts

- 12,226

Re: Occupy Wall Street protest

Re: Occupy Wall Street protest

hard4janira:

I understand your frustration and your belief that markets should be allowed to regulate themselves, but a lot of contemporary politics is derived from the experience of the 1930s when it was felt that the social consequences of failure were too great, that the depression was part of the rise of fascism and devastating world war, and that capitalism when it gets sick does not always have a cure for the patient.

It may be that the 1890 Sherman Act was the first attempt by politicians to use the law to intervene in markets, to break up monopolies that were perceived to prevent the 'little guy' from entering the market at all: but if there is a natural tendency in free markets to create monopolies, why should the state intervene? Rockefeller's Standard empire was broken up in 1911, but not the Microsoft empire; was the market involved in either of those decisions?

A powerful factor has been the growth of the modern state -the increase in intervention which followed the depression was politically motivated, but even though both Reagan and Thatcher tried to roll back the state from the economy, they could only do it it in part -because just in defence procurement alone, the US Government is one of the biggest sources of business in the USA; in all modern states now, the government is a regulator, and a producer, and a consumer -in a very real sense you cannot detach government, or the state from the economy -there can be no 'free markets', there can be no tax free rides on the gravy train.

Where I think you hit an exposed nerve, it is in the quality of institutions -the application of existing laws on contracts without political interference, and the quality of advice and the application of law by regulatory agencies. It beggars belief that the Bank of England or the UK Treasury had no staff whose monitoring of markets and whose specialist knowledge of financial isntruments could not follow and analyse the movements of capital over two or three decades and work out what was happening by 2008-this is what we pay good money for, and historically the Treasury was the smallest dept of government but had the brightest minds (!). Either that, or the papers being written for Gordon Brown were dumped in the bin just as Blair dumped expert advice on Iraq from the Foreign Office in the bin -I don't know about the Treasury but the latter is true. But if we are paying experts £75,000 a year for advice the politicians don't want to hear, why bother paying for it at all?

And what about inter-state unions? We used to have the Hanseatic League, and there was the Communist International, and now the European Union -some English Tories (and the Little Englanders in the Labour Party like Tony Benn) did not object to joining a common market but think the European Union is too many political steps too far, even though a cursory knowledge of the Treaty of Rome should have alerted them to its origins and ambitions. The enlargement of the Union is made on political rather than economic grounds -just as the decision to let Greece into the Euro was political and a mistake. But can the Euro survive if the reality is that not just Greece, but Ireland, Spain and Portugal -conceivably even Italy- are thrown out of it? It even begs the question in an age of globalisation, why should the European Union continue to exist at all, when it ring-fences its economies to provide a competitive advantage on world markets at the expense of small states in Africa, Asia and Latin America? Same with the British Commonwealth that offers preferential terms to its member states -?

I feel that the problem is that a) the modern state is now too embedded in capitalist economies for the operation of markets to be free of political interference or influence; and b) history shows that left to themselves, markets are too brutal, and the social consequences of failure are believed to be morally unacceptable -and isn't this why we have so many One Way Street protests?

-

11-01-2011 #732Banned - Long overdue. Junior Poster

- Join Date

- Mar 2008

- Posts

- 252

Re: Occupy Wall Street protest

Re: Occupy Wall Street protest

If you are referring to WW2 then I'd say that rise of facism was more directly tied to the rather draconian Treaty of Versailles rather than a failure of capitalism.

Your point that the Fed's intervention during the great depression due to the social consequenes is spot-on, I agree completley. I also agree that that is really the only reason governments continue to get involved. However, this country has seen it's fair share of financial panics (far more than most people realize) and the goverment did NOT always get involved. Still, capitalsim finds a way to pull through.

I do believe that there should be some regulation of the market by the government. Breaking up monopolies is one of them. The government should be concerned with maintaining fee and open markets. Too often however, they are engaged in crony capitalism, assisting business and/or unions rather than simply regulating the playing field.

We need to make the markets as free and private as possible. I support a constitutional amendment that balances the budget AND restricts Federal spending to a fixed percentage of GDP (say 18%).

Why can't government do it's job you're asking? Good question. All the more reason to make government smaller - because they constantly prove thier ineptitude time and time again. I don't trust big-goverment to save me or make the marketplace any safer with ever-increasing, bloated bureaucracies. I would be naive to think this is possible.

Every time I listen to an economist speak about the debt problem in Europe they all say the same thing: German and France have no choice but to recaptialze the banks, trim the debt, and eat a shit sandwich. What buggers me is that none of them seem to understand the political consequences of anything. If I am a German grandfather-clock maker in the black forrest, why should I have to suffer Greek citizin's addiction to debt and refusal to accept necessary austerity measures? Why?

Possibly. I think that markets CAN self-regulate much more than they are allowed to now. I think that government makes matters worse in many cases (particularly with social engineering initiatives such as CMA, FDA, Fannie and Freddie that exacerbate the real-estate bubble). I think that there is too much crony capitalism when governments are involved (with unions as well as large corporations). I think people in goverment are corrupt and self-serving just like people in the private world, therefore I do not believe government has the citizens best interests in mind even if that is what they sell the voters. AND....we haven't even talked about the feasability of central banks and fiat currencies... the damage that it causes and the power it gives corrupt goverments to run up mountains of debt....

-

11-02-2011 #733Senior Member Platinum Poster

- Join Date

- Jul 2008

- Posts

- 12,226

Re: Occupy Wall Street protest

Re: Occupy Wall Street protest

To take some of your points in sequence:

If you are referring to WW2 then I'd say that rise of facism was more directly tied to the rather draconian Treaty of Versailles rather than a failure of capitalism.

When the coalition parties in the 1940s inn the UK began developing the social welfare legislation that the 1945 Labour government put into law, it was a response to the appalling conditions of the inter-war years, and because David Lloyd-George had claimed that soldiers returning from the first World War would have a 'country fit for heroes to live in', sadly typical of Lloyd-George's Liberal bombast. The fear of fascism was based on the perception that in its initial phases in Germany and Italy it was perceived to have been economically successful, hence the danger of its appeal to the working class; it was not a claim that economic depression itself was the cause of war.

I think that markets CAN self-regulate much more than they are allowed to now. I think that government makes matters worse in many cases (particularly with social engineering initiatives such as CMA, FDA, Fannie and Freddie that exacerbate the real-estate bubble). I think that there is too much crony capitalism when governments are involved (with unions as well as large corporations). I think people in goverment are corrupt and self-serving just like people in the private world, therefore I do not believe government has the citizens best interests in mind even if that is what they sell the voters. AND....we haven't even talked about the feasability of central banks and fiat currencies... the damage that it causes and the power it gives corrupt goverments to run up mountains of debt....

The problem with this argument is that it was precisely the reliance on self-regulation that enabled the whizz-kids in finance to develop financial products whose end result was to encourage borrowing at an unsustainable level; the mirage of figures suggested huge flows of capital were lubricating the system when in effect the borrowing was drowning it. As for government, I think it is now too embedded in the state economy for a detachment to be truly effective if it is job creation you want. Efficiency too often gets translated into job losses, when it should really just mean hiring people who are good at their job and don't have to make you jump through eleven hoops to get something done that used to take a phone call or a visit to a local office.

The European Union is actually in danger of breaking up; it isn't just the Euro that is in crisis. I have always supported European integration for political reasons because of the history of war and prejudice, and feel that economically the European states will trade with each other anyway because of geographical propinquity as much as commercial logic. The problem with the European Union is that because it confers advantages on its members, everyone wants to join the club. We have admitted Israel into the European Broadcasting Union, but not Morocco, just as we have given Israel preferential status on a raft of economic activities, but not Syria. To me, Israel is a Middle Eastern not a European country.

And, because of geography and some bogus claim on our intellectual history, modern Greece wanted to be in it, and not only that but was also let in to the Euro even though it did not meet the criteria for membership. Having joined, the succession of venal governments, staffed for the most part at the top by the same families that have ruled Greece since Metaxas, and staffed below by an increasing nomenklatura of friends, and friends of friends, proceeded to pretend it was not just shipping magnates who could be rich in Greece, even though the shippers actually have assets and can run a business.

One of the bizarre results of recent research -by a Greek- that is so telling, shows that there are more owners of the Porsche Cayenne in the town of Larissa than anywhere else in the world. Larissa is in agricultural Thessaly. The research went on: "A couple of years ago, there were more Cayennes circulating in Greece than individuals who declared and paid taxes on an annual income of more than 50,000 euros.”

(story is here:

http://blogs.telegraph.co.uk/finance...-euro-incomes/)

If you ever wondered where all the money went, now you know. The problem is that this recklessness which was motivated by greed and political ambition, threatens to so undermine the Euro that it could undermine the EU itself, because voters who are outraged by the bankers who award themselves for failure, are deeply unhappy about the direction the EU has been going in. That Greece is now painting the Germans as the villain really is outrageous, but characteristic of the denial too many of them live in.

So I am now wondering if 2008 marked the beginning of a major structural shift in global capitalism, not just the confirmation of Asian supremacy in manufacturing, but the break-up of the European Union -possibly even of the UK- and the relegation of North America to second tier status. Any thoughts on this?

Last edited by Stavros; 11-02-2011 at 12:37 AM.

-

11-02-2011 #734

Re: Occupy Wall Street protest

Re: Occupy Wall Street protest

are those ferals still there.Our Aussie cops gave our lowlifes a kick up the arse and told them not to come back because people were complaining about them

live with honour

-

11-02-2011 #735

Re: Occupy Wall Street protest

Re: Occupy Wall Street protest

I think your ferals might be more feral than our ferals. The real ferals (homeless and just released Riker's Island prison inmates) are taking advantage of the free grub, sleeping arrangements, supplies and committing acts of sexual abuse and violence on the protestors.

...this was of course entirely predictable.

-

11-02-2011 #736

-

11-02-2011 #737

-

11-02-2011 #738Banned - Long overdue. Junior Poster

- Join Date

- Mar 2008

- Posts

- 252

Re: Occupy Wall Street protest

Re: Occupy Wall Street protest

I have to defer here. I am not familiar enough with the history of British politics to comment (or European for that matter).

Like I said before though, I do not think that the derivatives were transparent enough to the shareholders and the market. If we lacked the oversight to make them transparent to the market then I fully believe that we need to have that in place (so we agree here). I think the Volker rule addresses this somewhat (in an otherwise heaping lump of maggot infested shit called the Dodd-Frank Wall Street Reform act). To your point, the CDO's cooked up by the whizz kids (not the swaps mind you) encouraged the mortgage brokers lend more and more. However, the ease of access to credit was the fault of the Federal Reserve not Wall Street. I don't see how it is possible to keep intersest rates artificially low for nearly a decate and not expect there to be a bubble of some kind. The GSE's and the Federal government were also co-conspirators in the lowered underwriting standards (no-doc loans) as well. Let me be clear: There is nothing wrong with the CDO instrument itself. It is an wonderful and ingenious idea that is supposed to spread the risk of fixed income assets. Where it fails is when credit rating agencies LIE about the risk that is in them and AAA securities are pawned off to unsuspecting customers with junk in them. If the ratings agencies did thier job this would be a non-issue. (That's not to say that the banks weren't complicit either - they knew what the ratings agencies were up to. In fact, a bank would take its business to another agency if it didn't get the ratings it wanted).

So yes, we need regulation enforced by government. I think we can agree here. Where you and I probably differ is what the government needs to be doing in order to ensure free and open markets. I don't have an issue with CDO's or credit default swaps as financial instruments. I have issues with shareholders not knowing how leveraged a company is in swaps (i.e. AIG's swaps on Lehman). I have issues with CDO's being sold AAA when they are not. I'm not even sure that I think that there should be a rule about how much leverage a company can have. To me, if it is public knowledge how leveraged company is then that risk gets factored into the stock price. Risk-reward.

Job creation (IMO) is best left to the market. If Uncle Sam get's its boot off the neck of business in this country, then the economy will grow. It's absurd to me to think that the allmighty government has the wisdom to create jobs when and where it deems necessary, and in the appropriate places for which there is actual demand. Many people (myself included) don't even think that the Federal Reserve Bank has enough insight into the economy to be setting the price of money effectively, so I DAMN sure don't believe that goverment knows BEST about when/where to create jobs. Bottom line: Stop putting crushing regulations on business and stop taxing them into oblivion. Stop threating them with lawsuits if they don't do this or that, or hire these people or that. Just take away the chains and let it grow. Government will be better off in the long run because tax revenues as a whole will grow as a result.

Maybe I'm wrong but I see the EU and the Euro as one in the same. I've always believed it to be a financial union, nothign more. As the euro goes, so goes the EU. It's really all about the euro I think. I don't know all of the rules as to who you let in or keep out - but if the Euro collapses, what then is the purpose of the EU? Are there trade agreements that are negotiated as a whole with the EU?

2008 was the beginning of the downward spiral. We (Europe / America) are all living and experiencing 'the great credit unwinding'. It will go on for many years, because Central Banks are too heavily involved in mucking things up. As far as I am concerned, right now China is the top dog: America is already 2nd tier status.

-

11-02-2011 #739

Re: Occupy Wall Street protest

Re: Occupy Wall Street protest

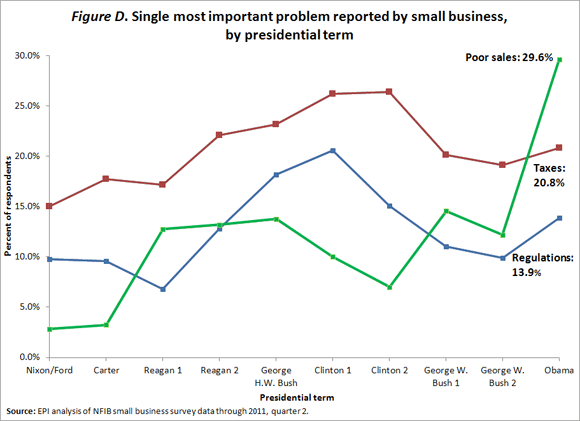

I think we agree about the need for increased transparency and regulation for complex financial instruments but your diagnosis of why unemployment is so high seems off base. Obama and Bush have done nothing but cut taxes and the economy has not grown except at the top. There is plenty of evidence suggesting that the current recession is caused by a lack of demand and not by excessive regulation or taxes. Here is just one such example.

Given that this recession is due to a lack of demand then I think the government has a pretty clear warrant for fiscal spending. The argument now is not who knows how best to spend the money but who is willing to spend at all. The private sector is not spending which leads to a vicious contractionary circle unless some other agent, the government, steps in to up demand. I'm also not arguing that the government should always be in the business of fiscal expansion; when the economy is out of the ditch the government can retract its spending and leave it up to the market. There is very specific case for the need for government spending now as opposed to later: high unemployment, low demand, low interest rates, cheap materials, cheap labor, crumbling infrastructure - they all point to the same solution: more or less Obama's job bill (although it could be bigger).

-

11-02-2011 #740

Re: Occupy Wall Street protest

Re: Occupy Wall Street protest

UK is part of the "EU" but we are not in the Euro hence GBP/sterling. Being part of the EU is a lot more than just a currency, the EU maintains a format of rules on trading , legislation, agriculture bla bla. For example Judicial precedent can be set by the European Court of Appeal that we have to adhere to.. ah the Human Rights Act.

If the Euro collapses then that affects nations currencies and we get guilders and pesetas back!!

The Englsih T'Rose - My Independant Porn Site

Meet Me - My Independant Escort Information

Twitter - Free Pics, chat shit.

Adultwork - My Webcam of choice,pics,vids

Similar Threads

-

The Continuing Disaster of Wall Street, One Year Later

By techi in forum Politics and ReligionReplies: 3Last Post: 11-18-2014, 03:35 AM -

Wall Street Occupation...

By Ben in forum Politics and ReligionReplies: 80Last Post: 12-07-2011, 11:06 AM -

Wall Street Turns Back on Obama, Donates to Romney

By Ben in forum Politics and ReligionReplies: 4Last Post: 10-03-2011, 02:21 AM -

The stimulus is working says The Wall Street Journal

By natina in forum Politics and ReligionReplies: 16Last Post: 12-02-2009, 04:30 PM -

Wall Street speed dial gets Tim Geithner directly...

By Ben in forum Politics and ReligionReplies: 0Last Post: 10-18-2009, 01:44 PM

Reply With Quote

Reply With Quote